Republican Firebrand’s Investment Boosts BuzzFeed Shares

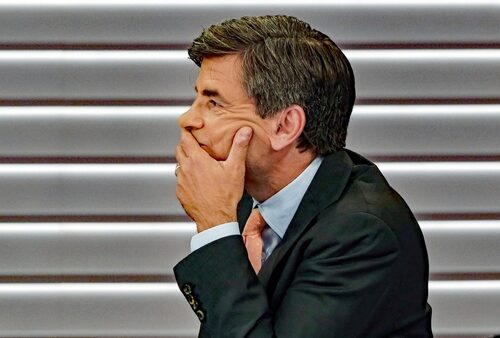

Former Republican presidential candidate Vivek Ramaswamy has made waves in the media landscape with his recent acquisition of a stake in BuzzFeed, driving up the company’s shares by 20% and sparking speculation about its future direction.

Ramaswamy’s purchase of a 7.7% stake and 2.7 million shares in BuzzFeed has injected optimism into the liberal media outlet, which has struggled since its lackluster public debut in 2021. Initially going public through a special purpose acquisition company, BuzzFeed’s shares plummeted by 94% post-launch.

The biotech entrepreneur, known for his outspoken views against “woke” politics, hinted at potential developments following the investment, stating, “Stay tuned,” according to CNBC. The surge in BuzzFeed’s shares following Ramaswamy’s involvement underscores investor confidence in his strategic vision for the company.

STOCK WATCH 🚨

Vivek Ramaswamy, the former Republican presidential candidate, has acquired a large stake in $BZFD in order to “shift its strategy”. His 7.7% stake in the media company is worth more than $2.7M. The stock is now +141% over 3 months and +27% today as a result. pic.twitter.com/kl1BjP1jJB

— Wall Street Alerts (@MarketAlerts_) May 22, 2024

A filing with the Securities and Exchange Commission revealed Ramaswamy’s rationale for the investment, citing his belief in the undervaluation of BuzzFeed’s securities and identifying them as an attractive investment opportunity. In addition to acquiring the stake, Ramaswamy intends to engage with BuzzFeed’s leadership to explore operational and strategic enhancements aimed at maximizing shareholder value.

The filing outlines Ramaswamy’s plans to propose changes across various aspects of BuzzFeed’s operations, including management, board composition, and strategic direction. BuzzFeed, recognized for its diverse content offerings, underwent a significant restructuring earlier this year, including workforce reductions to improve financial efficiency.

Ramaswamy’s investment strategy will be guided by a range of factors, including BuzzFeed’s financial performance, market conditions, and potential investment opportunities. Despite inherent equity risks, Ramaswamy’s involvement in BuzzFeed has the potential to reshape the company’s trajectory and reinforce its position in the media landscape.

Commenting on Ramaswamy’s move, a source close to him emphasized the significance of his investment in BuzzFeed as a platform for free speech, highlighting the potential for substantial gains if the company’s financial fortunes are successfully revitalized.